[ad_1]

On-chain knowledge exhibits the true market imply worth of Bitcoin is valued at $29,700 proper now, making the extent of explicit significance for the coin.

Bitcoin True Market Imply Value Is At $29,700 Presently

In a brand new post on X, the lead on-chain analyst on the on-chain analytics agency Glassnode, “Checkmate,” identified how the BTC worth presently trades under the true market value foundation.

The “market value foundation” refers back to the common worth at which the buyers within the sector purchased their cash. One well-liked approach of calculating this value foundation is thru the “realized cap,” which measures the entire worth of the cryptocurrency by assuming that the worth at which every coin on the blockchain was final transferred is its true worth.

When this capitalization mannequin is split by the entire variety of cash in circulation, the “realized price” is obtained, which is the typical value foundation of the provision.

Nonetheless, this technique has some points, equivalent to a piece of the circulating Bitcoin provide being completely inaccessible (on account of pockets keys changing into misplaced). Plenty of this inactive provide would have traded way back, which means its value foundation could be shallow in comparison with at this time’s costs. Thus, if included within the metric, it will skew its worth away from actuality.

Checkmate and Ark Make investments’s David Puell got here up with “Cointime Economics” some time again, a brand new methodology that tackles the issues with the realized worth.

“Cointime Economics introduces a simplified framework to effectively low cost the affect of misplaced provide and amplify financial impacts on the actually energetic provide,” explains Glassnode.

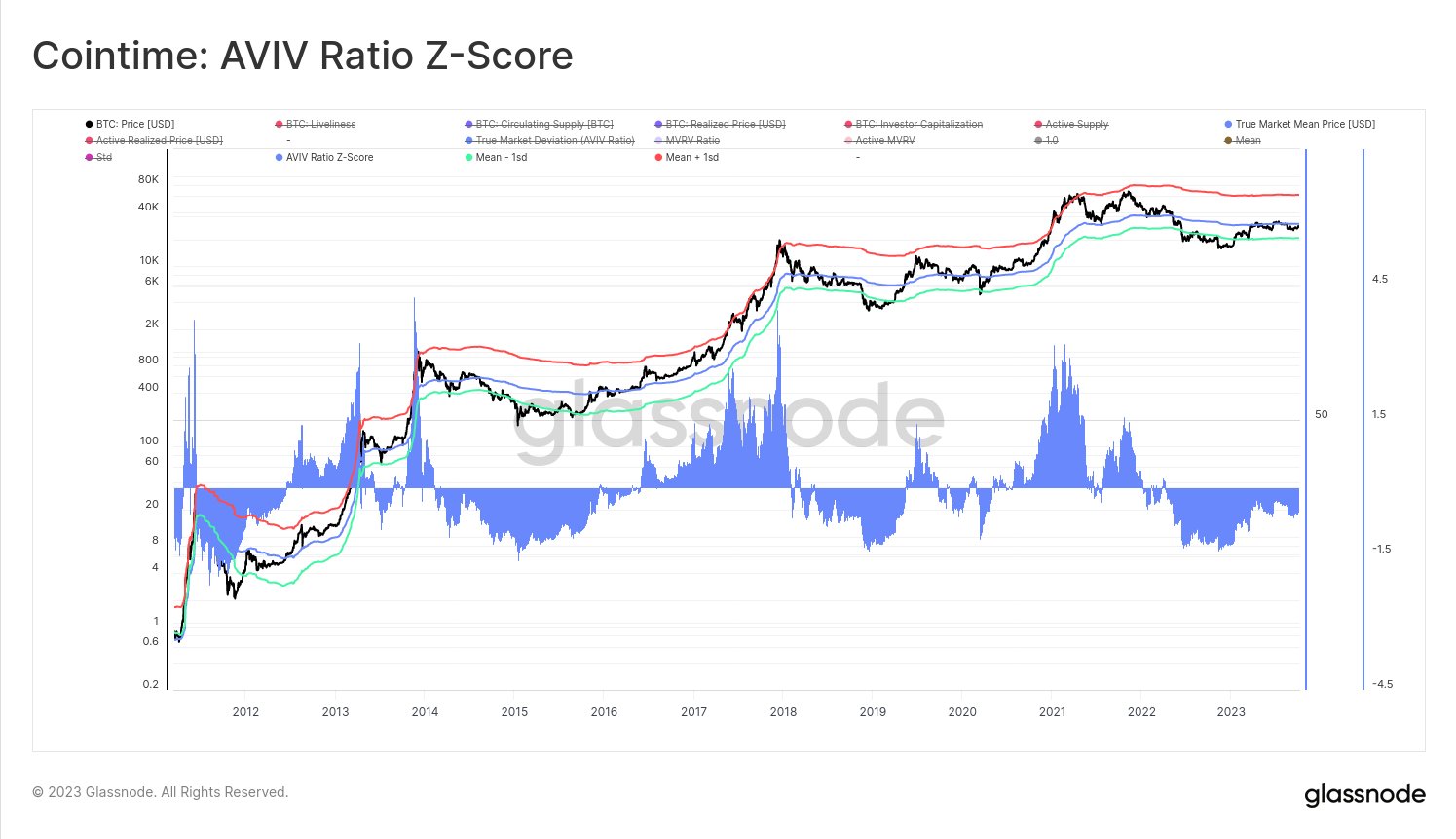

The chart under exhibits the development within the “true market imply worth” for Bitcoin, as calculated by this superior mannequin.

Seems just like the spot worth of the asset is presently under this line | Supply: @_Checkmatey_ on X

Based mostly on this extra correct mannequin, Bitcoin presently has a real imply worth of $29,700. Due to this fact, the asset’s spot worth is buying and selling nicely under this stage.

The graph exhibits that vital breaks above this indicator have traditionally resulted within the cryptocurrency having fun with some sustained bullish momentum.

Checkmate has additionally connected the “AVIV Ratio Z-Rating” knowledge in the identical chart. The “AVIV Ratio” tracks the deviation from the true market imply that BTC is presently observing.

The Glassnode lead notes that this indicator is probably the most correct measure of the market centroid for Bitcoin. On the present worth, the metric is “nonetheless -0.6 commonplace deviations under its long-term imply,” in keeping with the analyst.

The near-term consequence of the worth primarily based on that is unsure, however in the long run, Bitcoin may see a reversion again to its imply, thus making the present worth ranges doubtlessly worthwhile shopping for factors.

BTC Value

On the time of writing, Bitcoin is buying and selling at round $27,500, down 3% within the final week.

The worth of the coin seems to have registered some drawdown at this time | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Glassnode.com

[ad_2]