[ad_1]

A analysis agency has revealed an altcoin buying and selling playbook that would function a information for navigating the following cryptocurrency bull run.

K33 Analysis Shares Its Altcoin Buying and selling Playbook

In a brand new post on X, K33 Analysis (previously Arcane Analysis) defined that new altcoins make higher trades than outdated ones. The agency has given just a few causes for why that is so.

“In lack of price-driving fundamentals, the narratives and liquidity matter,” explains the analysis group. “And new cash typically outperform outdated cash.”

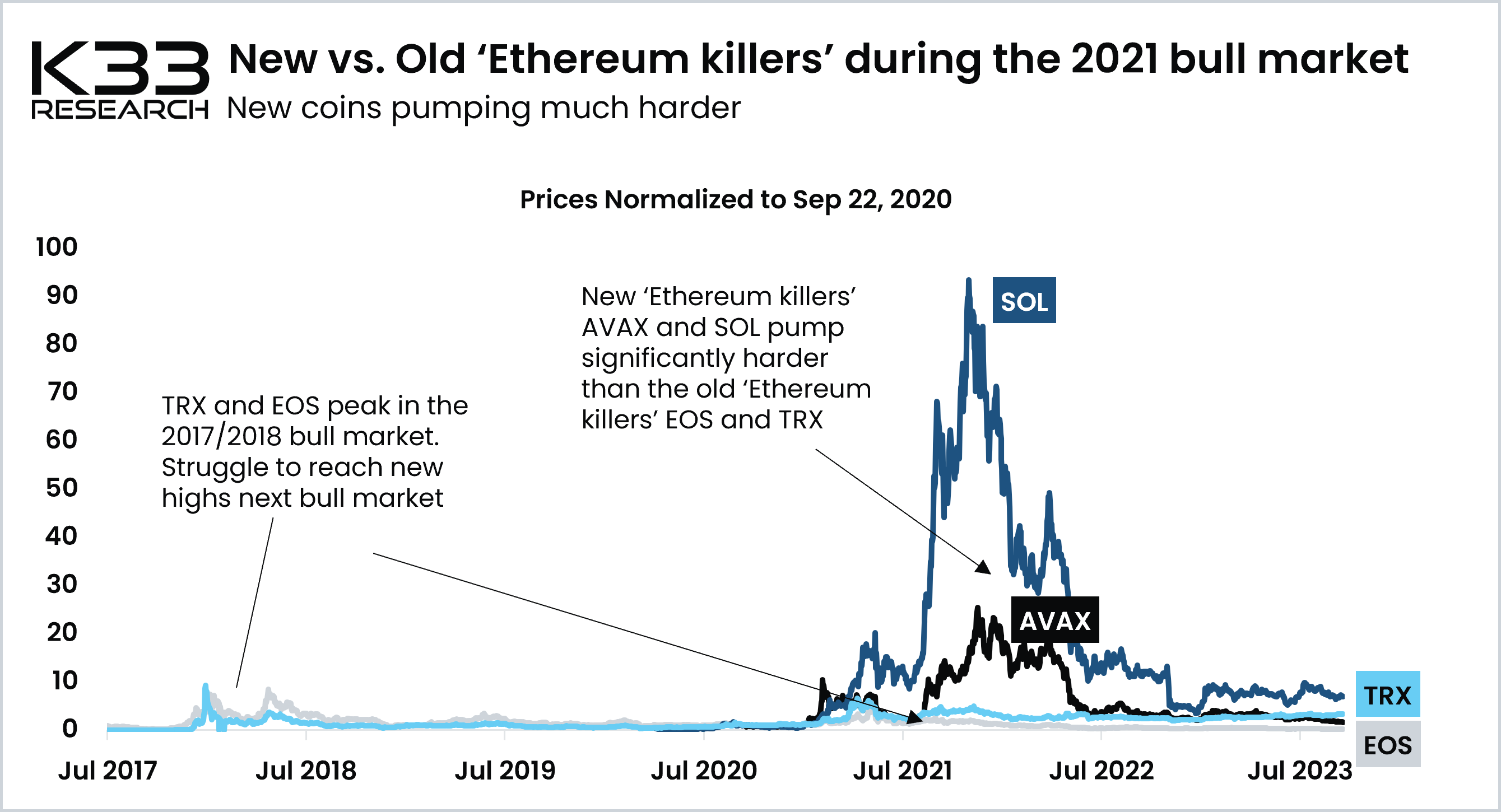

K33 Analysis has used the instance of some “Ethereum killers” over the last bull market to point out how the newer cash outperform the older ones. The under chart exhibits how the efficiency of those cash has been in contrast (word that the Y-axis, the worth, is normalized regarding September 22, 2020, right here).

How the brand new vs outdated Ethereum killers carried out through the 2021 bull mark | Supply: K33 Research on X

From the chart, it’s obvious that Tron (TRX) and EOS (EOS), which had been vouched because the Ethereum killers through the 2017/18 bull market, didn’t set new all-time highs (ATHs) through the 2021 bull run.

Nonetheless, the brand new children on the block, like Solana (SOL) and Avalanche (AVAX), noticed a lot better returns than the outdated, established altcoins through the newest bull market.

Why do outdated altcoins have issue returning to their former glory? Based on K33 Analysis, there are just a few components behind this. First, the cash which have gone by a cycle have many holders at a loss, ready to come back into the inexperienced to exit.

These underwater traders present extra promoting stress throughout rallies that new cash, the place everyone seems to be within the inexperienced through the preliminary rally, don’t need to face.

The outdated cash additionally need to take care of the rising circulating provide due to the token unlocks, which, resulting from supply-demand dynamics, can damage the worth if the demand facet doesn’t catch up.

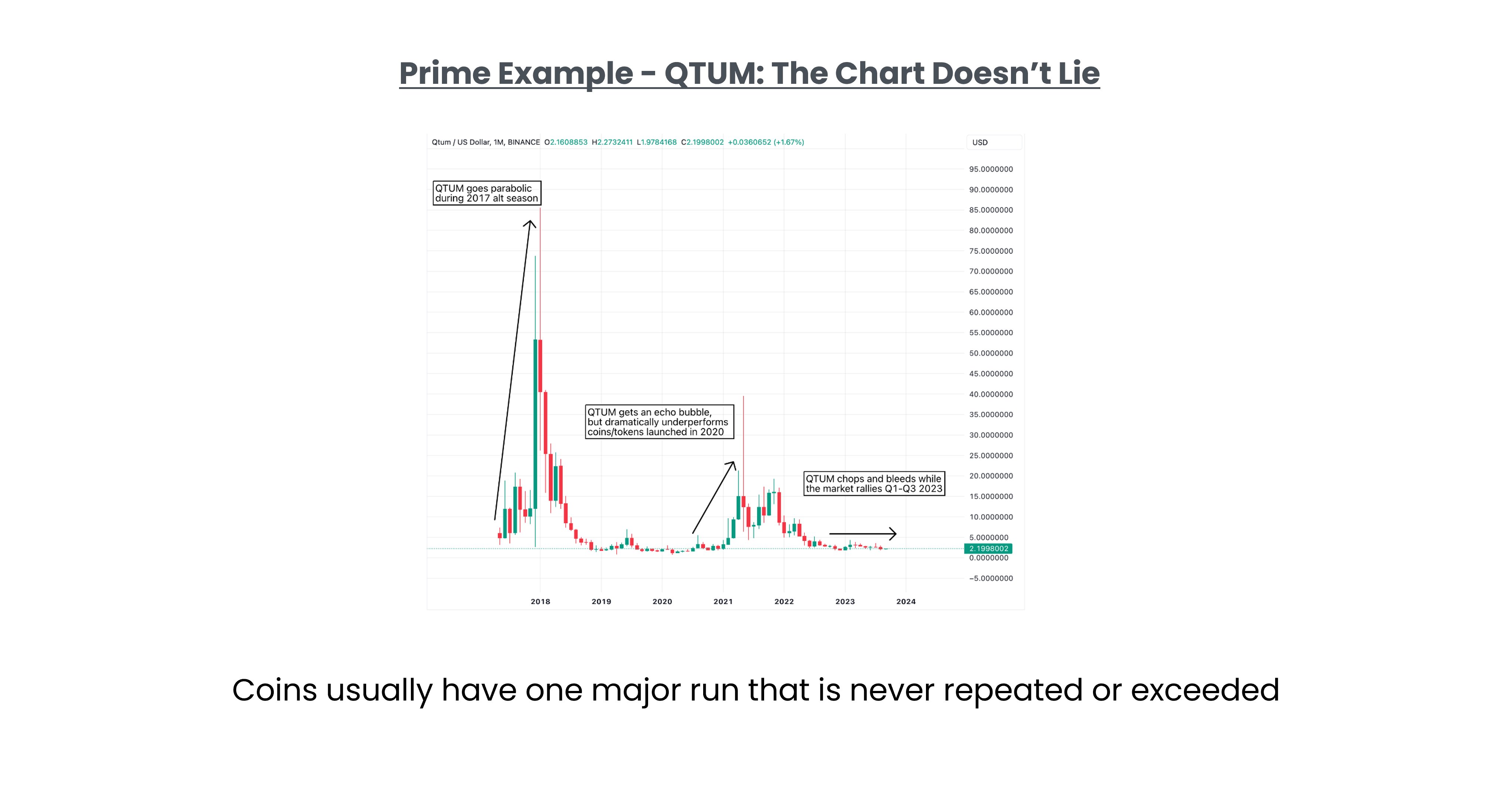

How QTUM's returns waned over time | Supply: K33 Research on X

Lastly, the analysis agency notes that outdated cash are additionally tied to narratives which have gone out of vogue. Then again, new cash are the narratives once they launch and, thus, seem attention-grabbing to traders.

Whereas new altcoins definitely have a leg as much as outdated cash relating to these components, K33 Analysis notes that not all such cash make for a great funding. The agency advises traders to search for just a few issues to know whether or not a mission could also be value investing in.

The very first thing may very well be whether or not or not the full variety of holders is rising quickly for the altcoin. A excessive quantity of adoption means the asset has extra steam behind it for constructing sustainable strikes. The agency additionally says {that a} low float and excessive totally dilated worth (FDV) ought to be averted.

ETH Worth

On the time of writing, Ethereum is buying and selling at round $1,600, up 3% through the previous week.

ETH has continued to maneuver sideways just lately | Supply: ETHUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, K33Research.com

[ad_2]